Weekly Market Insights - 24th January 2024

Let's dive into what's been happening in the world of investments this week.

Here's what I'll be covering in today's newsletter:

- Interest rates: a more gradual shift than expected

- Diverging trends

- World events affecting markets

- Fiscal approaches: US vs Europe

- The ongoing challenge of inflation

- Opportunities amid uncertainty

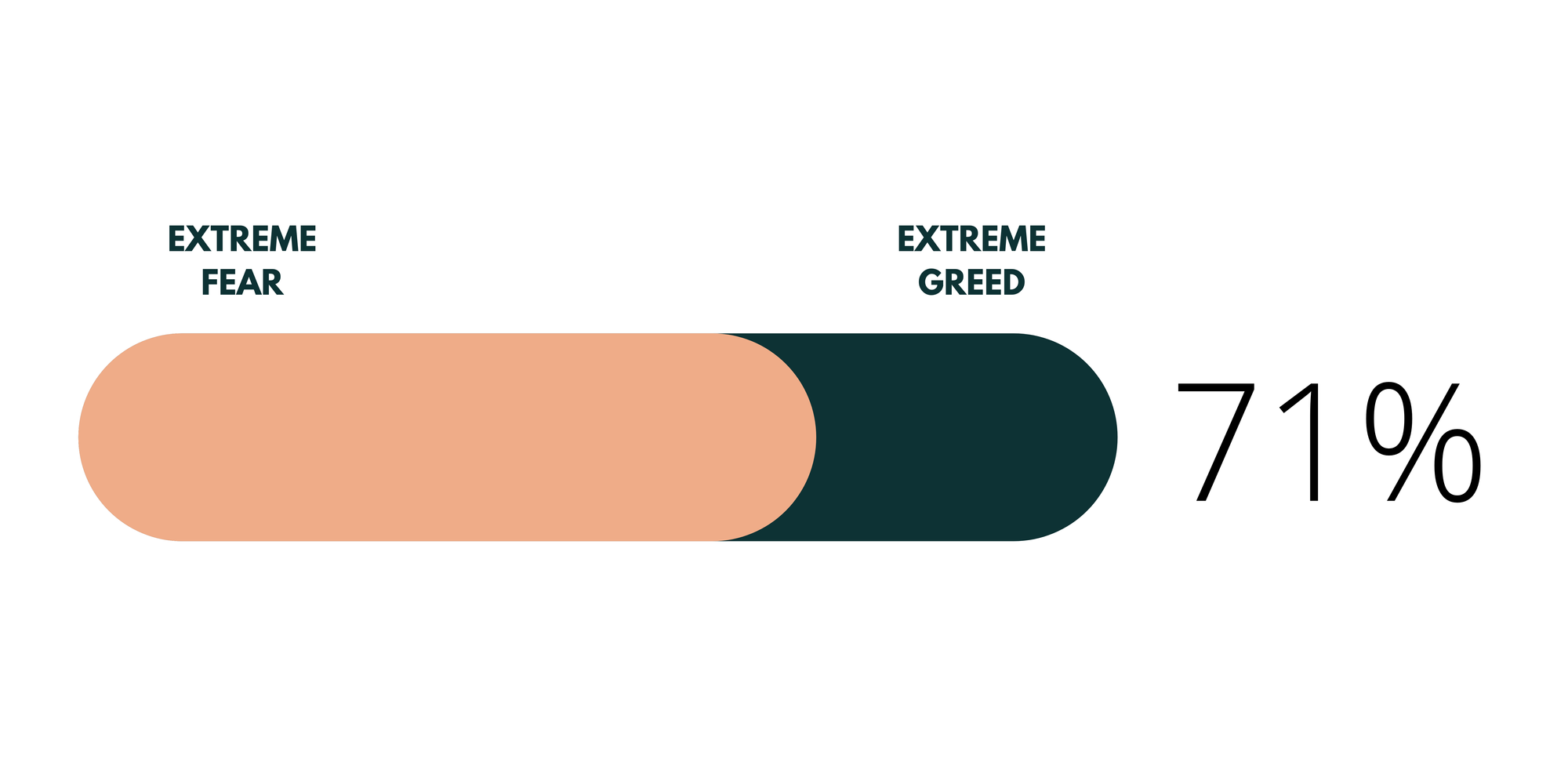

Current Market Fear & Greed

The current reading of 71% from CNN indicates a high level of confidence from investors. This hasn't changed in the last 2 weeks.

The stock market is a barometer of investor sentiment. When investors feel greedy, the market tends to rise; when they feel fear, it tends to fall.

Market Insights

In the world of investments, a lot can change in a week. Let's unpack the latest trends in simpler terms, but with enough detail to help you understand why they matter for your money.

1. Interest rates: a more gradual shift than expected

Interest rates are falling, but they're taking a little longer than we’d like. What's the impact? The rates you’re getting on your savings aren’t likely to change, keeping us in a high-interest environment for a little while at least. This means ongoing costs for loans but also gives you room to plan. For investors, it's critical to keep an eye on the influence of these changes across various sectors, especially those sensitive to interest rates.

2. Diverging trends

Major U.S. companies are performing quite well, in contrast to smaller firms and international markets. This situation underlines the stability of the largest companies in uncertain times and raises concerns about the broader economy. Rising yields in U.S. government bonds are nudging investors towards more secure assets. The main message? Diversify your investments and stay informed on international economic developments, as the hard times aren’t over just yet.

3. World events affecting markets

Global tensions, like those between China and Taiwan and the conflicts in the Middle East, have a direct impact on markets. These issues influence trade and oil prices, which can affect your investments. The China-Taiwan tension hasn’t started severely impacting trade yet, however it is causing disturbances in tech and manufacturing. In the Middle East, oil prices fluctuate with the state of conflict in the Red Sea.

4. Fiscal approaches: US vs Europe

The U.S. government is outspending its income, potentially fuelling short-term growth but with risks of long-term inflation. Europe's more cautious spending could lead to slower growth but a safer investment environment. Keeping up to date on fiscal strategies is vital when preparing for market opportunities and risks.

5. The ongoing challenge of inflation

The Bank of England faces a tough decision with inflation and interest rates. Usually, high inflation leads to increased rates, but too much of an increase can slow economic growth. On the flip side, low rates can encourage spending but may push up inflation. Currently experts are predicting rates will come down slightly by the end of 2024. These decisions have huge implications, from mortgage rates to investment returns, so keep a close watch on the BoE’s strategies.

6. Opportunities amid uncertainty

Some U.S. companies in technology, healthcare, and consumer staples are showing strong performance. Tech giants like Apple, Microsoft, and Alphabet are doing well as a result of increased digitalization, while pharmaceutical companies like Pfizer and Moderna benefit from ongoing demand for healthcare products. Retailers specializing in online shopping, like Amazon and Walmart, are also seeing strong results.

These companies are succeeding through innovation, strong market positioning, and efficient operations, offering investors potential stability and growth opportunities. For investors, these sectors are showing resilience and potential profit, demonstrating the importance of a diversified portfolio and the need to stay up to date on evolving market trends and company performances.

Navigating through change

To sum up, the financial world is intricate and constantly moving forward. Success hinges on staying informed, adapting to changes, and aligning decisions with your goals. Diversifying your portfolio and closely monitoring both economic and geopolitical shifts are crucial. It's about strategic and proactive investment management."