US Election Fallout, Rate Cuts, and Europe’s Economic Shifts

Let's dive into what's been happening in the world of investments this week.

Here's what I'll be covering in today's newsletter:

- US election results and what they could mean for prices

- Why the US and UK lowered interest rates – and what it means for you

- Germany’s debt debate: how Europe’s powerhouse is shifting

- Europe’s service sector struggles: why it matters

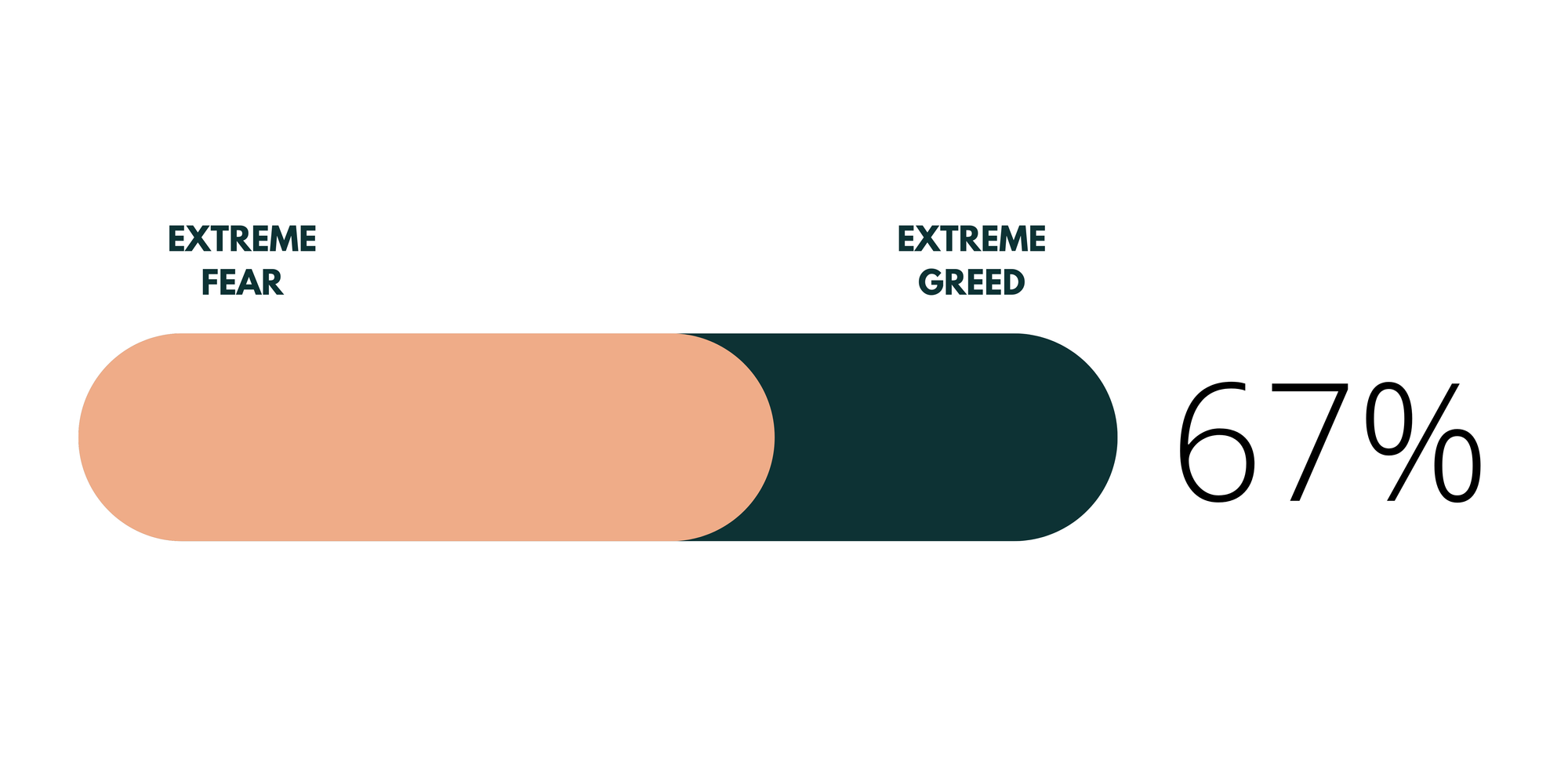

Current Market Fear & Greed

The current reading of 67% from CNN indicates a high level of confidence from investors. This has increased 23% from last week.

The stock market is a barometer of investor sentiment. When investors feel greedy, the market tends to rise; when they feel fear, it tends to fall.

Market Insights

Let’s break down this week’s top financial stories and what they could mean for your money.

1. US election results and what they could mean for prices

With Donald Trump re-elected, the US is likely to bring in more tariffs, especially on products from China. A tariff is a tax on items coming into a country, and these taxes often make imported goods more expensive. This can drive up prices across the board (a.k.a. inflation).

What this could mean for your finances:

- Prices might go up in the US: Everyday goods that are imported could cost more if tariffs go up.

- The dollar could get stronger: A strong dollar means US goods become pricier for other countries, which could impact global trade.

- Some industries could do better than others: Financial, energy, and manufacturing companies might benefit, while industries that depend on imports (like car manufacturing) could face challenges.

2. Why the US and UK lowered interest rates – and what it means for you

Last week, both the Bank of England and the US Federal Reserve cut interest rates by a small amount. Interest rates affect the cost of borrowing and are a tool to manage the economy. Lower rates make it cheaper to borrow, which can encourage spending and boost growth.

- In the US: The Fed may keep an eye on inflation. If prices start rising too fast, they might raise rates again to help control it.

- In the UK: With recent tax increases, the Bank of England may hold off on more rate cuts as it balances growth with the risk of inflation.

3. Germany’s debt debate: how Europe’s powerhouse is shifting

Germany is having a big debate over its rules on government borrowing, and it could lead to political shakeups. Loosening these rules would allow the government to borrow more for spending on things like climate projects or defense, which could give a boost to the economy. But some worry that too much debt could be risky.

4. Europe’s service sector struggles: why it matters

Economic reports show that Europe’s service sector, which includes things like retail, hospitality, and healthcare, isn’t growing as fast as it could. Germany and France, in particular, are facing a slowdown, while the US service sector continues to do better.

From election results to interest rates and Europe’s shifting economic policies, it’s a busy time for markets. Staying on top of these changes can help you make smarter financial decisions.

If you’d like to talk through what these updates mean for your finances, book a free consultation with me, and let’s get a plan in place.